Digital Assets have created for some innovative fortunate in investors great returns. For others their investment has been lost. A sample of our research into the trading and investment of digital assets can bees seen below articles. We are not providing any investment advice here but is posted purely for research and discussion. In 2020 David Burke and Zeno Goldsmith tested live trades of a private investment from January to March 2020 and recorded an approx 53 percent return. However this was just a test and we are not taking on any outside funds at the moment to trade or invest. Remember with any investment you have a chance of losing or winning.

Among these VC players are Pantera Capital. As reported by multiple sites, the fund amassed returns over 10,000 percent over the last several years by investing in and trading bitcoin. The incubator arm of Pantera leads investments in altcoin trading on high-volume exchanges, utilizing an algorithmic trading approach. The Pantera team posted this letter on their official Medium site in July of 2018 regarding its involvement with blockchain and cryptocurrency based investment. Pantera’s blockchain SEC filing documents can be found here. According to ICO Data from the website Hackernoon about how much money made by investors in best 100 ICO’s… “some early investors are making as much as 50,000% returns on ICOs. Early investment is paying off in massive ways.”

2017 saw some incredible returns for investors in ICOs. Some of the leaders of the pack are listed below:

ROI : $100 in their ICO = $14,151 today

One-liner : Privacy focused Ethereum

Why it maters : Komodo is yet another platform

ROI : $100 in their ICO= $36,600 today

One-liner : Lets blockchains communicate with other blockchains.

Why it maters : There are many cases for businesses to create and maintain their own blockchain. Ark aims to allow easy communication between different blockchains. Rather than having a bunch of independent data stores and platforms with Ark there is the potential for a network. The need for this network will likely increase as more and more blockchains are created.

Return : $100 in their ICO= $50,834 today

One-liner : Privacy focused cryptocurrency

Why it maters : Privacy focused cryptocurrencies like Monero nd Zcash have been getting a lot of attention lately. Spectre-coins claim to fame is that it provides network privacy by running within the TOR network

2017 Mangrove Capital reported “If one had invested blindly in every ICO, including the significant number of ICOs that failed, this would have delivered a 13.2x return (1320 percent return on investment).”

The Mangrove report highlighted tokenizations implications for the venture capital industry. It examined the potential of tokenization and explains why ICOs could radically change how private companies raise capital. It also provides an analysis of how this funding mechanism is being used today, explores how ICOs could impactthe venture capital operating model and examines the likely shape of a suportive regulatory framework.

• Many ICO projects are serious, and deserve consideration

• As the mechanism develops, VCs need to change their thinking

• With regulatory acceptance, an ICO will be a very normal method of raising capital.

According to the report: “At a rate of 1,320%ROI, ICOs beat out even bitcoin’s prodigious rise over the last year.”

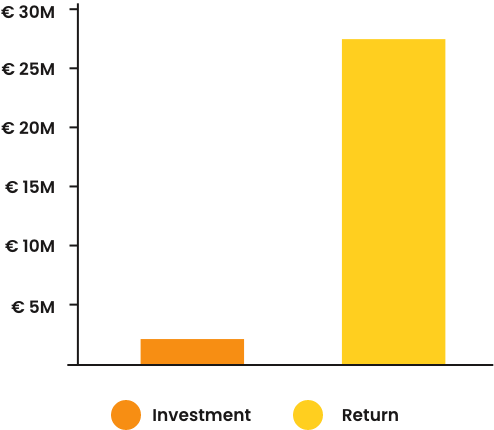

If one had blindly invested €10000 in every visible ICO, including number of ICOs that failed this would have delivered a *13.2x return

The list of 100 ICO’s ranging from 2830% return to 100% return for ICO participants.

“Traditional venture capital (VC) investment in blockchain and crypto firms has almost tripled in the first three quarters of 2018, according to a new Diar report published on September 30. Diar cites data from Pitchbook that reveals blockchain and crypto-related firms have raised nearly $3.9 billion in VC capital. This $3.9 billion represents a 280 percent rise as compared with last year.”